More dentists than ever are retaining the services of a dental marketing agency in support of their dental practice growth plans. The most often-cited reasons for doing so are a desire to manage their patient mix between third party reimbursed and fee for service, desire to add an associate, and as a response to inroads from competitors, most notably DSOs.

According to Mike Abernathy*, 50% of practice growth should come from new patient flow, which makes choosing to work with a reputable agency, having a proven track record, and whose sole focus is dentistry, a logical decision.

*Summit Practice Solutions E-Letter (10-29-20).

If your experience with dental marketing has been less than stellar, the first question to be answered is “Where did I (or my marketing firm) go wrong?”

Dental marketing agencies unlock the power of the web for healthcare providers*

77% of patients used search prior to booking an appointment. With the growing percentage of the population consisting of Millennials, that number will only increase.

50% subsequently referred family, friends, and colleagues. Digitally secured patients are as likely to refer as are patients generated internally or via conventional external marketing methods such as public relations, cause marketing, and direct mail. 43% of new patients watched patient testimonials before scheduling an appointment, while 30% of patients who watched an online video booked an appointment. Video is a critical component of an effective digital dental marketing campaign. Finally, 56% of new patients used the click-to-call feature on their cell phones to book an appointment.

Taken together this means that, to ensure rapid, cost-effective growth, the internet is the biggest, if not the only, game in town, at least in terms of external marketing.

Law of Comparative Advantage

The decision to retain the services of a reputable dental marketing agency is further bolstered by what economists call the Law of Comparative Advantage, attributable to David Riccardo and James Mills, two nineteenth-century economists. The theory holds that an entity, be it a country, company, or individual, should concentrate all its efforts on the task at which it is ‘most-best.’ It assumes the variable to be maximized is profit, that is, it does not take into consideration non-monetary benefits such as entertainment, mentoring, and other forms of fulfillment and gratification one might derive from such other pursuits.

*https://www.investopedia.com/terms/c/comparativeadvantage.asp

Once Bitten (by a Dental Marketing Agency), Twice Shy

Along with the increase in the utilization of dental marketing agency services by dental practice owners, a concomitant, and unfortunate, the consequence is that a greater number of dentists are being disappointed by the gap between promises and results delivered by their agency.

The main cause is an inability (and, in a sadly increasing number of instances, an unwillingness) on the part of the dental marketing agency to present clear, reasonable, and achievable expectations to their clients. Largely responsible for this is the relatively recent arrival of what I term Big Box Internet Stores.

To a surprising degree, these entities are funded by private equity firms whose primary motivation is the maximization of the return for their investors within a given (usually 3-5 year) time horizon. That leads the company to be more concerned with aggressive marketing tactics to build their book of business than it is achieving quality results for those who are paying the bills; their clients.

The perception of what constitutes a fair and reasonable investment in dental practice growth has become further obscured by such agencies. In too many instances “over-promise, under-deliver” has become the prevailing theme.

The ‘going rate’ offered by these stores is around $300 to $600 per month. When you consider that, in any reasonably competitive area, the investment required to generate a new patient average around $300, even a well-managed program will be unable to generate meaningful results at that level of investment.

What’s “Fair?”

What constitutes a reasonable investment for your dental practice growth plan rests upon a number of factors including the above-mentioned competitiveness of your service area, your timeframe, and your goals.

“Rule of Thumb” estimates pegged to monthly collections assert that, if you are solely interested in stemming attrition, that is, replacing people who leave your practice with just enough to maintain your current patient base, you should invest two to three percent of monthly collections on marketing. If you want to increase new patient volume at a moderate clip the investment should be five to seven percent of monthly collections. If you plan to grow aggressively to, for example, add an associate, you will want to invest in the vicinity of ten percent of collections.

De novo practices are advised to invest upwards of 20% of projected production so earmarking a reasonable portion of startup funding towards a strategic marketing program is a necessary first step.

Return On Investment

Of course, it’s wholly reasonable to ask “What may I expect in return for my investment (and when)?” To calculate that let’s assume an average new patient acquisition cost of $300. The typical new patient spends an average of $700-$1250 in their first year, while the average patient will remain for 7 to 10 years.

Based on the foregoing, the average lifetime value of a patient, regardless of its source, is between $3,200 to $7,600. That means if one invests $2000 per month, a reasonable expectation is 7 new patients per month. Return On Investment is simply calculated by subtracting investment from return and dividing by investment.

Return = Number of Patients (7) x Average Patient Lifetime Value (we will assume this to be $5000)

Investment = $2000

Therefore, ROI = $14,000-$2000/$2000

Or 600%.

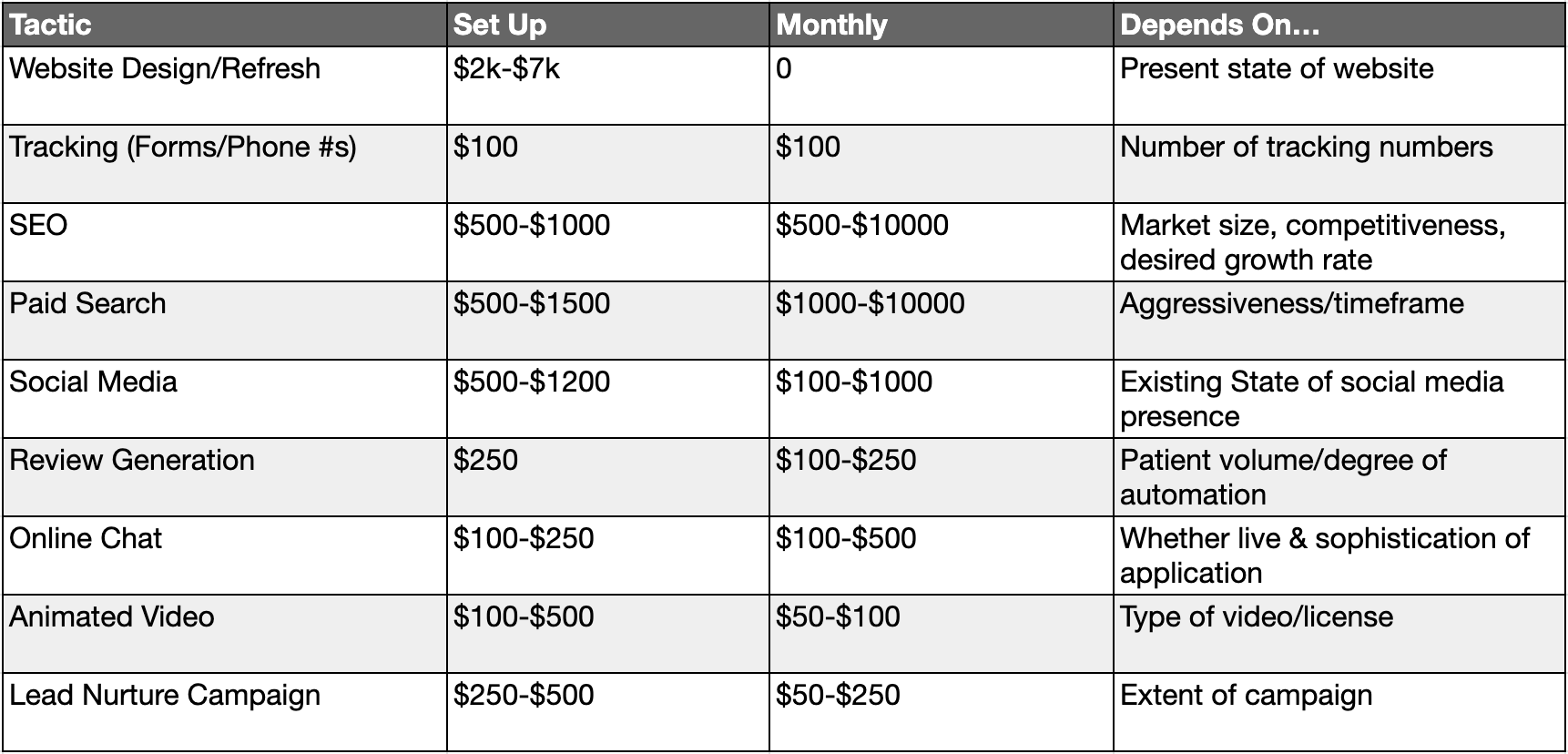

Following is a table, which details the investment for a given task/tactic as well as the variables upon which that investment depends:

Perform Your Due Diligence

When my brother and I started our dental marketing agency in 1989 we could count on one hand those companies offering a similar service for dentists. Now that number is in the hundreds, with new entrants arriving seemingly daily. As noted above, many of these new entrants are funded by private equity firms that have become aware of the potential to earn a handsome return by aggressively marketing to dentists, promising them spectacular results for next to no investment. It is this type of entity, which has resulted in so many dentists being disappointed with the results of their marketing investment.

While it will require a bit of time and effort there simply is no substitute for deliberate research and comparison shopping. Do not fall into the trap of assuming all dental marketing agencies are the same and therefore, the price needs to be the only decision criterion. As with dentistry, price is but one consideration. A true fit goes well beyond the investment. As with most things, dentistry included, results are typically commensurate with investment, that is to say, “you get what you pay for.”

As part of your due diligence, the following questions should be asked and the information requested:

- How long has the firm been in practice? Experience matters.

- Does the firm specialize in the dental field? Profession-related experience matters.

- Will the firm allow you to speak with current and former clients? Trust, but verify.

- Does the firm require a large advance payment and a long-term contract? Reputable firms strive to keep your money in your pocket until they truly need it, and are sufficiently self-assured as to not require a long-term contract. Clients should remain a client because they want to, not because they are contractually obligated to.

- How does the firm demonstrate an understanding and sensitivity to your unique situation? Does it customize a plan to meet your needs, or do they employ a “one size fits all” approach? Do they provide a fully transparent, regularly updated, and easily understood online interface, which presents their results?

Transparency and Accountability – Trust, But Verify!

There are certain key performance indicators (KPIs) about which your marketing agency should be reporting. KPIs to watch include so-called “bottom of funnel” results: new patient volume (and how this compares to your agreed-upon goal), new patient acquisition cost, and your “team batting average,” that is, their success with converting calls from prospective patients into solid, and kept appointments. “Mid-funnel” KPIs include so-called conversions. These are indications of some desired action being made by prospective patients including phone calls, form completions, chat-bot engagement, and reviews activity. “Top-of-funnel” KPIs to watch include: total website visits, percentage of new vs. repeat visitors, page load speed, bounce rate, time on site, paid search impressions and click-through rate, traffic lost to budget, and more.

New Possibilities

The properly conceived, implemented, and monitored dental marketing plan places the practice owner squarely in control of their practice growth plan, and can mean the difference between success and failure. Conversely, a plan that is poorly conceived, executed and, therefore, rendered non-actionable can mean frustration, wasted opportunity, and costly. That’s why it makes sense to become familiar with the means for vetting, selecting, and evaluating the dental marketing agency that will help you navigate dental marketing landscape and come out the other end a winner.

Here’s a free glimpse at AIM Dental Marketing’s Dental Marketing Dashboard 2.0